Outlook for Stock Markets and the Vienna Stock Exchange 2015 Mostboeck: “ECB asset purchase program continues to impart momentum to stocks”

- ATX: Catch-up potential until year-end

- Valuations remain attractive

- Triple digit earnings growth: 2015e: +106%

Catch-up potential for Vienna Stock Exchange

The majority of companies in the ATX had to report significant earnings revisions in 2014. In addition, geopolitical risks in the context of the Russia/Ukraine conflict exerted a negative effect. There were fundamental reasons for Vienna's disappointing performance last year. The ECB's asset purchase program (quantitative easing) creates a better outlook for the euro zone. Positive surprises in terms of GDP growth at the beginning of the year are also giving rise to expectations of improved prospects in the major CEE countries: “The significantly improved environment and the digestion of last year's one-off effects are creating notable catch-up potential for the ATX”, notes Fritz Mostboeck, Head of Group Research at Erste Group. Rising trading volume at the Vienna Stock Exchange is confirming this trend.

Recommendation: real estate and dividend stocks

Austrian real estate stocks have suffered significant price declines in recent months, which was inter alia attributable to rising yields on long term government bonds. “Considering that 3-month Euribor remains in negative territory and real interest rates are still negative, such an extent of interest rate-related fears is in our opinion inappropriate”, says Christoph Schultes, senior analyst of CEE Equity Research. Consequently, current prices represent a good buying opportunity. Top picks in the sector are currently CA-Immo, Immofinanz and UBM. Moreover, stocks with high dividend yields should be favoured, among others UNIQUA and Vienna Insurance Group (VIG). The latter was recently dropped from the MSCI Austria Index, which has put additional pressure on the stock. Small and mid cap companies with “special stories” are likewise on the list of recommendations of Erste Group Research: Technology stock AT&S (expansion in China), Porr (favourable valuation), Palfinger (strong growth) and Polytec (positive market environment). “In summary, after the recent decline in prices we once again see numerous interesting investment opportunities”, Schultes says.

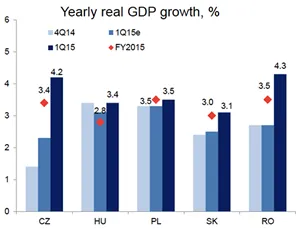

Catch-up potential in the CEE region

A positive growth differential in favour of Central and Eastern Europe as well as attractive valuations suggest further catch-up potential for the region. On a global level, the economic recovery remains subdued. In a relative comparison, the CEE countries are exhibiting significantly stronger growth than the major developed nations. CEE vs. euro zone: 2014e: +2.7% (vs. +0.9%), 2015e: +3.0% (vs. +1.5%). Austrian stocks are already benefiting to a large degree from this region or they are successfully active in global niche markets. Important metrics, such as e.g. P/E ratios, or dividend and earnings yields compared to bond yields are signalling catch-up potential for the Vienna Stock Exchange in 2015 and 2016. “All in all, we should be able to regain the highs seen earlier this year”, Mostboeck concludes. According to the forecast of Erste Group's analysts, the ATX should reach a level of around 2,650 points by the end of the year.