14.08.2017

Erste Bank Savings and Credit Forecast Q2 2017

Survey: Every fifth Austrian adjusts investment behavior in response to low interest rates

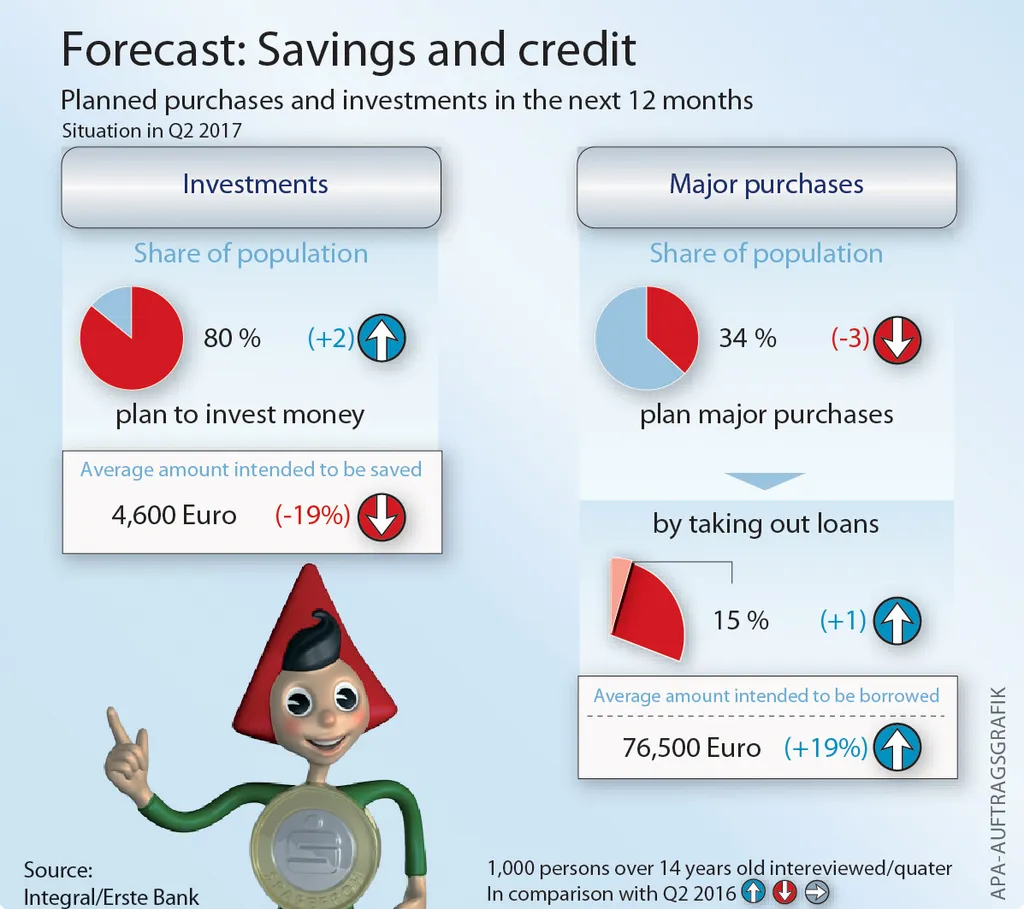

- Average savings amount stands at EUR 4,600 (-19%)

- Average loan amount rises by 19% to EUR 76,500

12-month savings amount decreases

Eight out of ten Austrians want to set money aside in the coming 12 months – this is according to a survey conducted by INTEGRAL on behalf of Erste Bank. Among the various forms of investment, traditional ones continue to be ranked at the top: savings accounts remain in first place for 57% of respondents, followed by building savings contracts (47%). Even so, one third of those surveyed state that they want to take out a life insurance policy or join a pension plan. 24% plan to purchase securities (+2%). Plans to invest in gold remain unchanged: 15% (±0) intend to buy the precious metal and every fifth respondent wants to invest in real estate, which is just one percentage point lower than in the corresponding period of the previous year. With respect to the average amount earmarked for saving, a decrease from EUR 5,700 to EUR 4,600 was observed (-19%).

Average loan amount rises by 19%

The same percentage by which the planned savings amount has declined has been added to the average amount people intend to borrow. Almost one third of Austrians plan to spend money on a costly project or make a major purchase such as e.g. an apartment renovation or a new car. 15% want to finance this by either obtaining credit from a bank or another type of loan. While the planned loan amount averaged just EUR 64,000 a year ago, it has increased to EUR 76,500 this year. Austrians increasingly appear to opt for safety in connection with long-term loans. Already more than eight out of ten mortgages extended by Erste Bank comprise fixed-rate loans of late. “Interest rates remain low, and in this way one will at least enjoy a predictable rate and face no surprises over the bulk of the loan's term”, notes Thomas Schaufler, chief retail officer of Erste Bank.

Low interest rates: One fifth of respondents change their investment behavior

Central bank base rates have been extremely low for many years, which has in turn put pressure on interest paid on savings deposits. Nearly three quarters of Austrians state that they have nevertheless refrained from changing their saving and investment behavior. However, one fifth of those surveyed have reacted by searching for alternative investment opportunities to replace low yielding savings deposits. It is clearly evident though that these investors are primarily found in households with a monthly net income in excess of EUR 2,000. All the same, investment in securities does not depend on having large amounts at one's disposal. Erste Bank generally recommends to use savings accounts and building savings contracts for short to medium term investment. “In order to build up a financial cushion over the long term – whether for retirement purposes or to fund the education of one's children – there is no alternative to investing in securities”, Thomas Schaufler points out. “With inflation at just below two percent and base rates at zero, money in savings deposits will obviously suffer a loss of purchasing power.” According to Erste Bank estimates, a first small rate hike by the ECB should be expected at the end of 2018 at the earliest.

About the study: Integral has interviewed 1,000 Austrians (representative of the Austrian population aged 14 and over) via telephone about their planned savings and their preferences regarding forms of saving and investment, as well as their financing needs. The survey was conducted in the 2nd quarter in the time period 06. June to 20. June 2017. Unless stated otherwise, all figures are in comparison to the corresponding quarter of the previous year.