30.01.2018

Erste Bank forecast on savings and loans Q4: Only one out of ten Austrians shows interest in the apps developed by fintechs

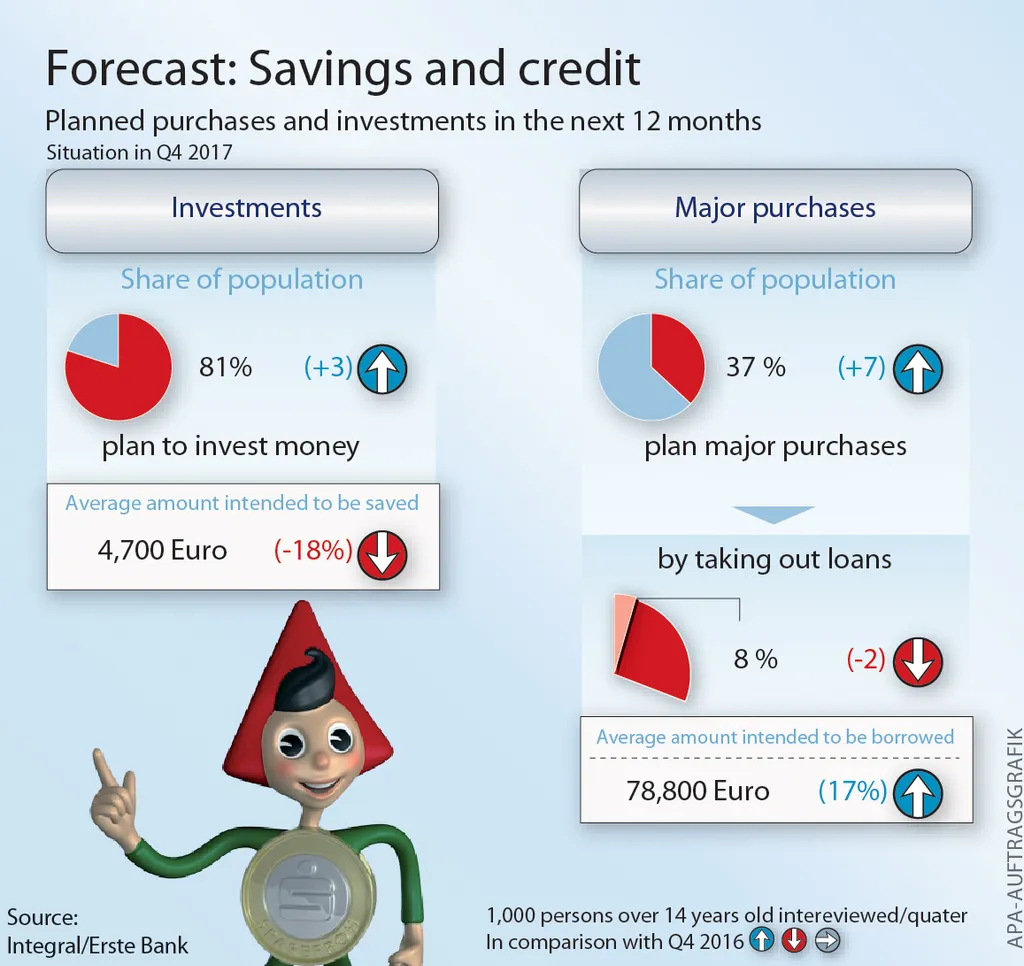

- 12-month savings amount drops to EUR 4,700

- Every 7th person wants to invest in stocks

- Lending volume up to EUR 78,800 (+17%)

Scant interest in apps by fintechs

The new European Second Payment Services Directive (PSD2) places an obligation on banks to make customer data available to third parties such as fintechs when customers request this because they want to use special financial apps to manage their financial life. However, Austrians’ interest in such financial apps is rather low. Only 10% of Austrians consider such apps attractive. “We are the better fintechs. With over 1.5 million users of George, we have a clear edge here,” said Thomas Schaufler, Retail CEO of Erste Bank. George, the most modern banking service in Austria, was designed already three years ago with a view to developments relating to PSD2 and combines all of the innovative elements required of modern and mobile banking in this era of digitisation. Moreover, the platform is designed so as to permit third parties to also dock onto George. “Therefore, all George users benefit from services that offer them real added value without having to turn to other apps or platforms,” explained Schaufler. Currently, we are preparing the launch of an innovation jointly with a start-up that will be integrated into George and will offer a service unique in Austria. This service simulates future life events such as the purchase of a car or loss of a job and then calculates how it causes one’s financial situation to develop.

Rising popularity of securities and real estate

The propensity of Austrians to save money is steady. Currently, 84% are planning to invest money in the coming 12 months. Especially households with a net income of over EUR 2,000 are showing a higher inclination to set money aside; 9 out of 10 intend to invest money during this period (92%). The top three investment forms continue to be savings passbooks (62%), savings in building society schemes (50%) and life insurance (39%). While classical savings products stayed on a stable course, a growing number of Austrians are considering investments in real estate (19%/+5) and securities (28%/+4). “This development is very pleasing,” commented Schaufler on this trend. ”It is especially important in times of low interest rates to diversify assets broadly and to also add securities to one’s personal investment portfolio. This is the only way to build a financial nest egg over the long term.” Interest in equities is especially high: every seventh person is deliberating an investment in stocks; one year ago, it was only every ninth person.

Young people in buying mood

On average, Austrians plan to set aside EUR 4,700 this year – EUR 1,000 less than a year ago (-18%). This is also noticeable in the planning of major purchases. Four out of ten Austrians have major purchases on their agenda (37%/+7). It is, above all, young people aged 14 to 29 who are considering buying a car, an apartment or similar (44%). Almost 90% want to finance these purchases with their own savings, and in 9% of the cases, friends and relatives help out. Bank loans are an option for larger purchases for 8% of people. In this case, the average amount of a loan is EUR 78,800 (+17%).

About the study: Integral interviewed 1,000 Austrians (representative for the Austrian population over the age of 14) by telephone asking about the ways they were planning to save and invest their money and also about their financial needs. The survey took place in the fourth quarter from 30 November to 19 December 2017. Unless otherwise indicated, the figures of comparison are from the same quarter of the previous year.