26.04.2018

2018 housing study: Low interest rates driving the push for home loans

- Sparkasse Group estimates six billion Euros in loans needed for renovation plans over next ten years

- One in two tenants would like to own their own home

- New: Erste Bank und Sparkassen decide on loan approval within 24 hours

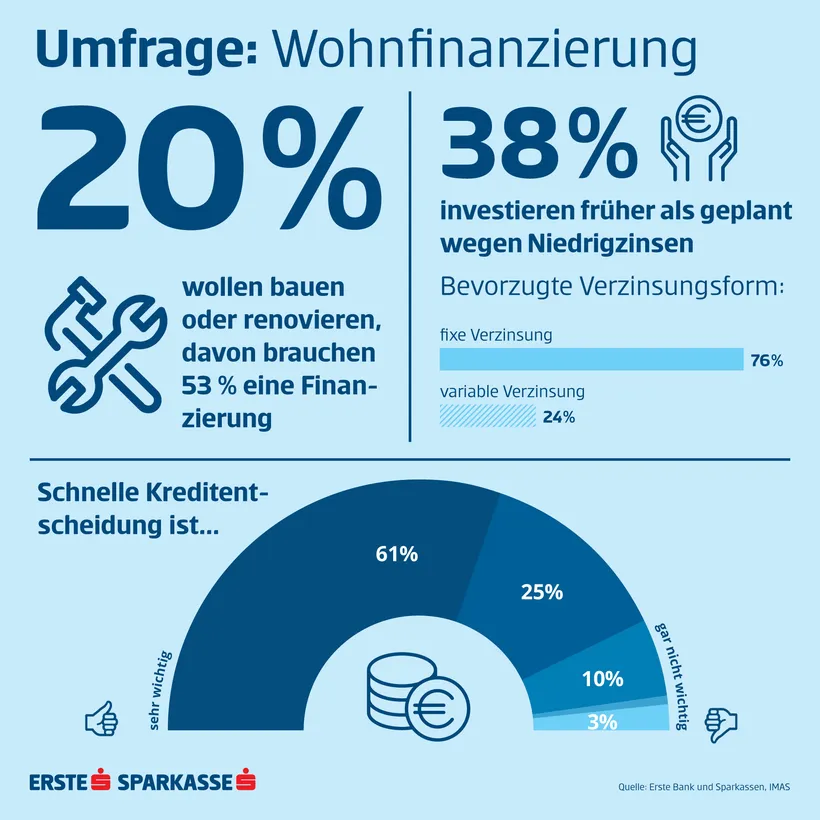

Half of all Austrians would like to change their housing situation, and one in five (20 percent) already has plans to build or renovate in the near future. More than half of these need financial support for this. “Our experts estimate that almost six billion Euros will be needed in loans for private property renovations over the next ten years. Anyone wanting a loan will need to act soon. We anticipate the interest market to get moving again by 2019 at the latest, which is why we recommend fixed interest”, says Thomas Schaufler, Director of Private Customer Business at Erste Bank. Eight in ten Austrians expect banks to decide quickly on their loan approval, which is why Erste Bank und Sparkassen now guarantee home-loan approval decisions within 24 hours.

Fast decisions required for loan approval

86 percent of Austrians consider it important for home-loan approvals decisions to be made quickly, and Erste Bank und Sparkassen now offer a 24-hour express approval decision. Once the consultant has all the documents, a decision can be guaranteed within 24 hours. “This short turnaround time is made possible by a newly developed tool which aids the decision-making process by technically assessing the risk guidelines,” says Schaufler. In the past, credit-rating checks could take up to two weeks.

Low interest rates driving rush for home loans

To make the most of the ongoing low-interest phase, many Austrians are giving preference to building and renovating their homes. Karin Kiedler, Head of Market Research at Erste Bank notes that “it is particularly interesting that 72 percent of women find energy efficiency very important in renovations, whereas only 55 percent of men thought this was a priority.” According to a representative IMAS study conducted on behalf of Erste Bank und Sparkassen, more than a third of Austrians wanting loans to finance their renovation projects would bring their plans forward. Erste Bank analysts expect the first interest-rate rise to come in mid-2019.

Austrians prefer fixed interest

In cases where a loan is required, three quarters of all Austrians surveyed would currently tend to opt for fixed interest, while a quarter prefer variable interest. “At present, 85 percent of new loans are fixed-interest contracts. Borrowers should get in early to secure interest at this low rate. In addition to the low interest, the repayments remain the same throughout the selected period, which is a key benefit of fixed-interest contracts”, adds Schaufler.

One in two tenants would like to own their own home

61 percent of Austrians own their own home. 39 percent rent, and half of these (49%) would like to own their own home. In the last year alone, the Erste Bank und Sparkassen have financed 22,600 people’s dreams of having a home of their own. When asked whether they would currently want to change anything about their current living situation, one in two Austrians says yes.

Living costs 40 Euros higher than last year

A typical Austrian household has 2.5 people, with an average living space of 115 sq m. Monthly costs are on average 651.10 Euros. “A recent survey has shown that the average costs have gone up by almost 40 Euros per month and household compared to last year,” says Kiedler. More than a quarter of Austrians see property ownership as an investment. Home owners in particular (47%) consider their property to be both an investment and a provision for old age.

| PDF (743 KB) | |

| JPG (1008 KB) | |

| JPG (1 MB) | |

| JPG (1 MB) |

About the survey:

Erste Bank und Sparkassen hired the market research institute IMAS International to conduct a telephone survey about Austrians’ living situations. Between 5 and 23 March 2018, 900 people were asked about their current living situation, any changes they would like to make to this, and home loans. The results are representative of the Austrian population aged 18 and over, i.e. 7.2 million people.

%5Bgraphic%5D

Survey: Home loans

20% want to build or renovate, and 53% of these need a loan to do so

38% are investing earlier than planned due to low interest rates

Preferred type of interest:

Fixed

Variable

A fast loan approval decision is…

very important

not important at all

Source: Erste Bank und Sparkassen