07.05.2018

Erste Bank forecast on savings and loans Q1 2018

Survey: Ever other person plans to pay contactless more often

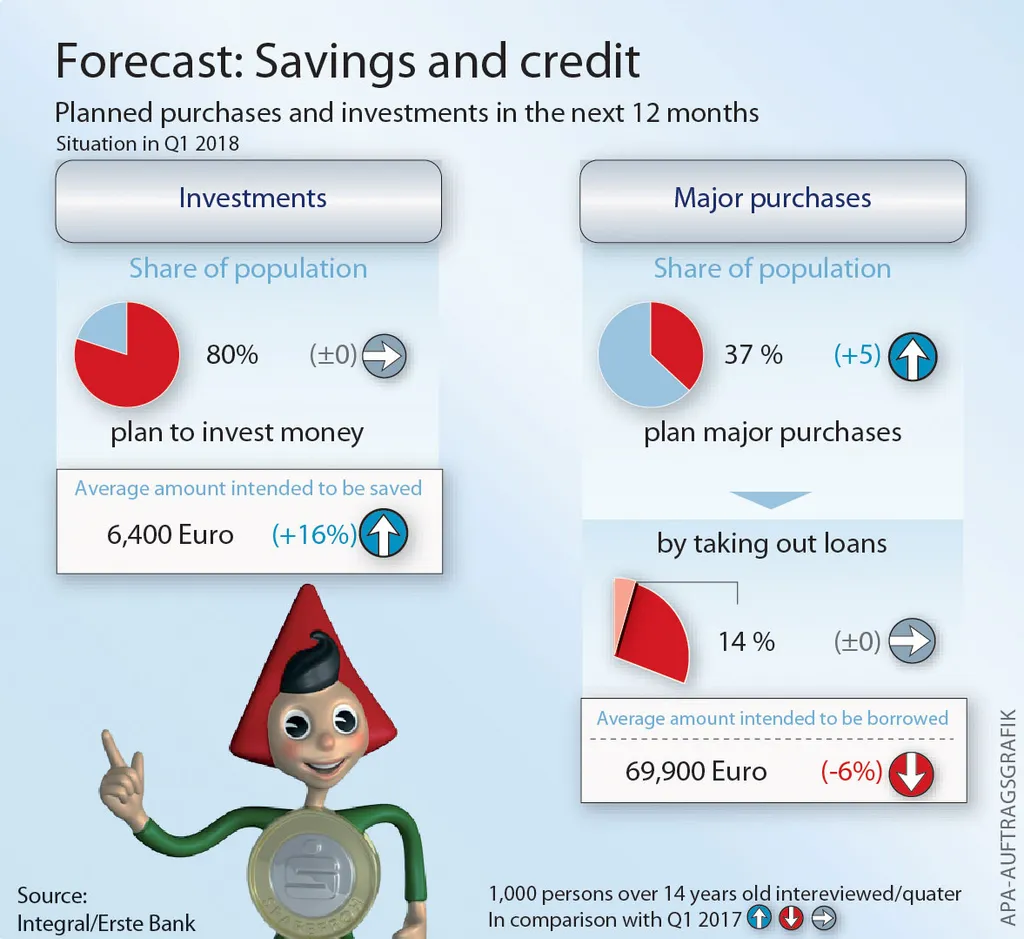

- Austrians plan to invest EUR 6,400

- Average loan amount is EUR 69,900

- Every other person plans to use contactless payment more often in future

Investments in securities regain appeal

According to a current INTEGRAL survey conducted on behalf of Erste Bank and Sparkassen, 8 out of von 10 Austrians plan to set money aside in the next 12 months. On average, an amount of EUR 6,400 are to be saved or invested. This is EUR 900 more than in the like period of 2017. The savings passbook is once again the most popular form with a share of 62% (+7), while savings in building society schemes accounts for 45% (-3) and life insurance for 34% (-6). Investments in securities have advance, rising from 24% to 27%. The rise is particularly steep for shares: 15% want to invest money in shares, while exactly one year ago it was 11%. “As long as interest rates are at such extremely low levels, the only way to fight inflation is to invest in a mix of securities,” explained Thomas Schaufler, Management Board member for Retail at Erste Bank.

Contactless payment gaining popularity

The popularity of contactless payment is constantly rising in Austria. Today, almost every other person pays at POS terminals using cards with NFC technology -- last year alone for nearly EUR 6 billion. “We also know that the willingness to use contactless payment is higher among our customers than the Austrian average,” said Thomas Schaufler. A possible reason is that around two years ago, Erste Bank and Sparkassen introduced the smallest debit card in the world embedded in a wristband, thus setting a new standard in payment options.

According to the survey, every second Austrian is considering to use contactless payment more frequently in the future and 10% are still undecided. At present, 17% are still rather sceptical and only one fourth cannot imagine using it at all. Contactless payment was introduced throughout Austria in 2013. Meanwhile, its use has spread and almost 70% of all POS terminals have NFC capability and a growing number of cash dispensers offer contactless cash withdrawals.

More Austrians planning major purchases

Currently, 37% (+5) of Austrians are planning a major investment such as home renovation or the purchase of a flat. Eight out of ten persons will finance this from savings, and 14% plan to take out a loan. The average loan amount is marginally lower than in the preceding year and stands at EUR 69,900 (-6%). And 29% of all persons planning to take out loans intend to borrow a sum of over EUR 100,000.

About the study: Integral interviewed 1,000 Austrians (representative for the Austrian population over 14) by telephone asking how they were planning to save and invest their money, and also about their finance needs. The survey was conducted in Q1 from the 1st to 27th of March 2018. Unless otherwise indicated, the figures of comparison are from the same quarter of the previous year.