08.01.2019

Erste Bank forecast on savings and loans Q3 2018

Survey: 42% of Austrian are looking forward to a hike in key lending rates

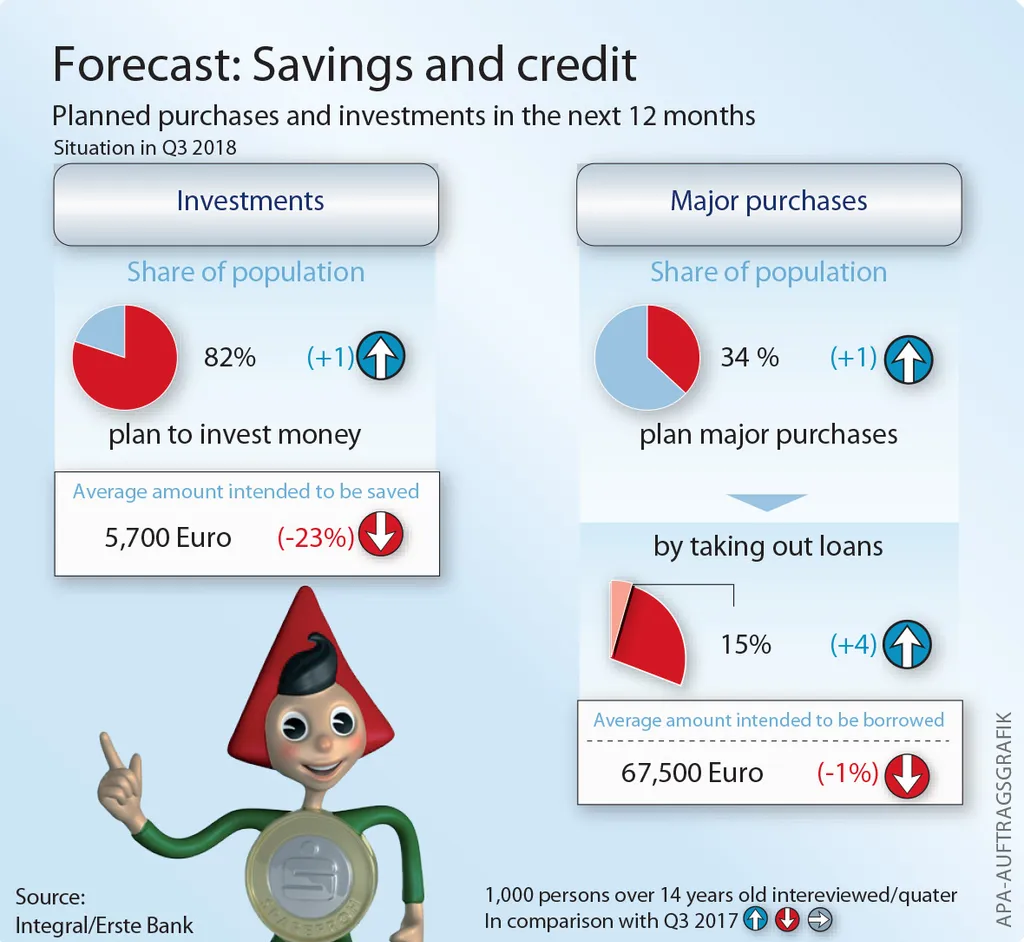

- Amount being saved drops to EUR 5,700 (-23%)

- Average loan volume EUR 67,500

The European Central Bank (ECB) is expected to lift the key lending rate by the earliest at the end of 2019. However, only if the economy continues to grow solidly in 2019 and inflation is high enough. According to a current study by Integral conducted on behalf of Erste Bank and Sparkassen, some 42% of Austrian are looking forward to the planned interest rate hike. “These are all probably people who have savings passbooks. However, interest rates will rise only very, very slowly – if at all – over the next few years,” said Thomas Schaufler, Retail CEO at Erste Bank. 26% are still unsure what to think about a change to interest rates. 28% take a negative view of an interest rate hike. “These are probably borrowers. We therefore are currently advising to opt for fixed-interest rates, as this means that the interest rate will not change even if there is a hike,” explained Schaufler.

Savings passbooks still in the lead, securities gaining ground

In the coming twelve months, savings passbooks will remain the trendsetter of investment forms. A share of 60% (+3) of Austrians plan to set money aside in savings passbooks or savings accounts. A percentage of 45% (-3) intend to save money in building society schemes, 38% (+3) will invest in life insurance policies and 32% (±0) want to start a retirement plan. At present, people are also open to investments in securities: 30% want to invest their money in stocks, investment funds and similar forms; one year ago, it was only 26%. ”This is a pleasing trend. Without a good mix, which definitely should include securities, it is not possible to beat inflation right now,” said Schaufler.

More purchases planned, less money for investments

Austrians currently plan to invest EUR 5,700, while the figure for Q3 2017 was EUR 7,400. Around 34% of Austrians are considering major purchases in the coming year, and this group includes, above all, persons with higher incomes. Most people (86%) will finance these purchases with their own savings, while 15% (+4%) will use loans. The average loan amount is EUR 67,500 (-1%). Around one third of people who are planning to take out loans intend to apply for a sum of more than EUR 100,000.

About the study: Integral interviewed 1,000 Austrians (representative for the Austrian population over the age of 14) by telephone asking about the ways they were planning to save and invest their money, and also about their financial needs. The survey was conducted in Q3 during the period from the 6th to 24th of September 2018. Unless otherwise indicated, the figures of comparison are from the same quarter of the previous year.