04.12.2017

Erste Bank savings and loan forecast for Q3

Survey: Funds in demand again due to zero interest rate

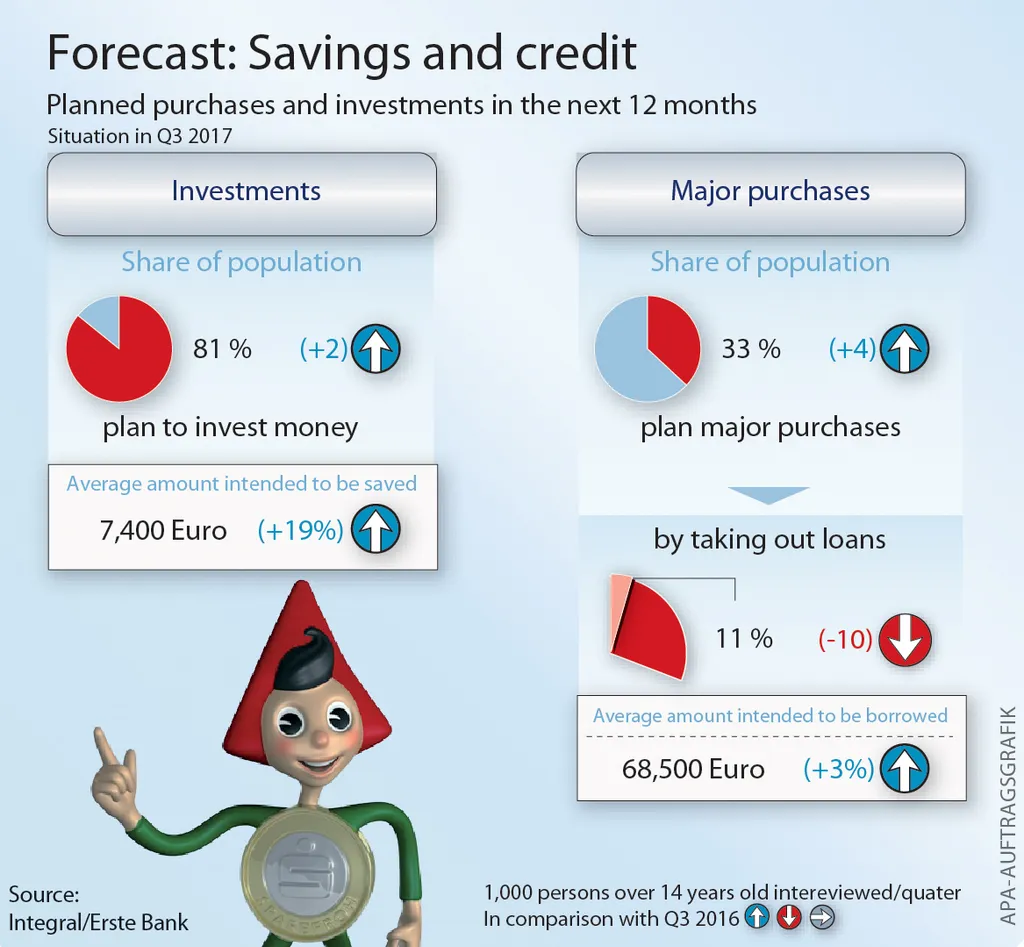

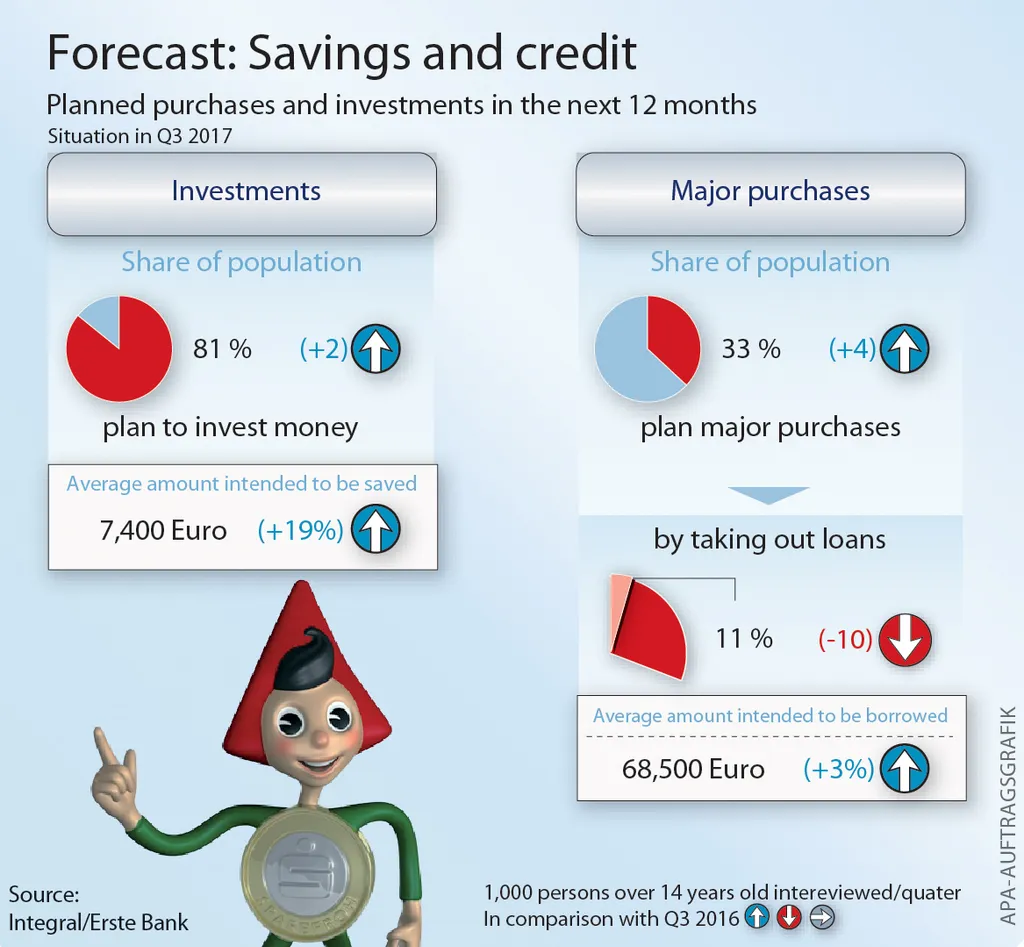

- 12-month saving amount rises to 7,400 Euros (+19%)

- More interest in funds: 18% want to set them up (+5)

- 2/3 consider personal contact at branches important

Funds firmly back on investor radars

Austrians want to once again put more money into funds over the next 12 months – such are the findings of a representative INTEGRAL survey conducted on behalf of Erste Bank und Sparkassen. Despite low interest rates, savings books continue to claim top spot (57%), followed by building savings contracts at 48%, while life insurance (35%) and pension insurance (32%) remain steady. Around 26% of Austrians want to invest in securities – i.e. shares, bonds and funds – over the next 12 months. The study found that the planned total to be invested during this time frame is 7,400 Euros – whereas this figure was just 6,200 Euros exactly a year ago.

Viewer people take out a loan

Around a third of Austrians are planning to make a larger purchase over the next 12 months, and 8 in 10 of these want to finance it with their own savings. Only 11% are currently thinking about financing it with a loan – which is 10 percentage points less than a year ago. Those who do want to finance their purchase with a loan, however, are planning to borrow somewhat more money. Currently, it’s an average of around 68,500 Euros, which is 3% more than in the third quarter of 2016. 41% are planning to borrow between 5,000 and 50,000 Euros, while 26% want to borrow more than 100,000 Euros. “Good advice continues to be important, especially for larger investments”, says Thomas Schaufler, Director of Private Customer Business at Erste Bank. And Austrians agree. Despite increased digitisation and the intense growth in online banking, two thirds of Austrians say they still value personal contact at branches. “This has cemented our path – despite digitisation, our branches and consultants remain an extremely important part of our retail strategy”, Schaufler adds.

Austrians want to once again put more money into funds over the next 12 months – such are the findings of a representative INTEGRAL survey conducted on behalf of Erste Bank und Sparkassen. Despite low interest rates, savings books continue to claim top spot (57%), followed by building savings contracts at 48%, while life insurance (35%) and pension insurance (32%) remain steady. Around 26% of Austrians want to invest in securities – i.e. shares, bonds and funds – over the next 12 months. The study found that the planned total to be invested during this time frame is 7,400 Euros – whereas this figure was just 6,200 Euros exactly a year ago.

Viewer people take out a loan

Around a third of Austrians are planning to make a larger purchase over the next 12 months, and 8 in 10 of these want to finance it with their own savings. Only 11% are currently thinking about financing it with a loan – which is 10 percentage points less than a year ago. Those who do want to finance their purchase with a loan, however, are planning to borrow somewhat more money. Currently, it’s an average of around 68,500 Euros, which is 3% more than in the third quarter of 2016. 41% are planning to borrow between 5,000 and 50,000 Euros, while 26% want to borrow more than 100,000 Euros. “Good advice continues to be important, especially for larger investments”, says Thomas Schaufler, Director of Private Customer Business at Erste Bank. And Austrians agree. Despite increased digitisation and the intense growth in online banking, two thirds of Austrians say they still value personal contact at branches. “This has cemented our path – despite digitisation, our branches and consultants remain an extremely important part of our retail strategy”, Schaufler adds.