Study: How does Austria save in times of low interest rates?

- Average amount saved at 201 euro

- The types of savers in Austria: 44% save in the “traditional” manner

- Only diversification can protect against inflation and low interest rates

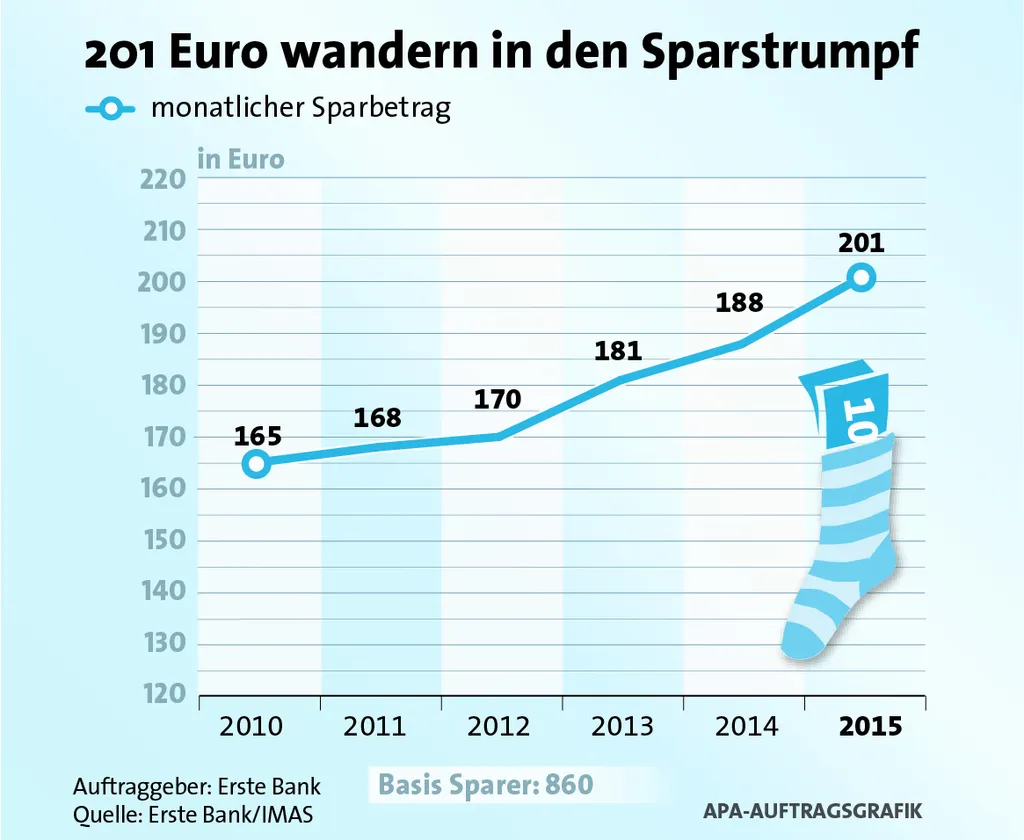

Are you satisfied with how much you are saving? Every second respondent answers this question of the 2015 savings study conducted by IMAS on behalf of Erste Bank und Sparkassen with yes. Austria-wide, the average amount saved stands at 201 euro per month – however, satisfaction with this rate of saving is at the same level as 10 years ago, when only 132 euro per month could be saved. In addition to this, the importance of saving has declined to the lowest level in 10 years: For the first time almost one third of respondents state that savings are not important to them.

Savings book suffers due to low interest rates

The interest rate landscape doesn't make things easy for Austria's savers at present. Reactions to low interest rates vary widely though. One quarter aren't concerned with this circumstance at all and simply leave their savings in current accounts. Around one third have either gifted their money to relatives, another third has bought real estate, securities or gold. While the savings book remains the most popular form of saving for 77%, it has nevertheless lost some of its popularity in the past ten years (-6%). Building savings accounts remain a perennial favourite with 65%, which have gained in popularity over the past ten years, along with securities, investment funds and bonds (28%). What are Austrians saving for? A rainy day fund remains in the top spot for 85%. However, over the past ten years, saving for renovations has also gained in popularity: the level has almost doubled to 41%. “Renovations are mainly undertaken if one has money left over and e.g. doesn't want to invest it. Low interest rates have ignited a kind of renovation boom”, says Peter Bosek, member of the management board at Erste Bank.

Austria continues to save: the three types of savers in the country

- Traditional savers save around 174 euro per month and want to provide for their retirement. They have a sceptical view of securities and are betting on classical products such as the savings book, the building savings account or life insurance policies. As a reaction to the low level of interest rates they simply leave money in their current accounts or enter into long term contracts such as e.g. life insurance policies.

- Those who save little are on average setting aside 156 euro per month – one third of them state that they don't have enough money available to save. In this group the savings book, resp. the building savings account are the number one savings products, however, every fifth has no savings vehicle at all. Every fourth is interested in the topics of money and saving, is however not quite sure how to invest his or her money.

- Versatile savers regard early provision for retirement as a must. They are setting aside the highest monthly savings amount of 297 euro. Every fifth is prepared to take risks in investing money, and every second often gives thought to what the best form of investment would be. Three out of four are of the opinion that they have found the best form of investment for themselves.

Is there an alternative to the savings book?

Savings books and building savings accounts are suitable products for the short term accumulation of savings. However, if one thinks about retirement, funding the education of one's children or generally about long-term wealth accumulation, one has to consider diversification. “Unfortunately the topic only becomes particularly obvious to many people once interest rates on savings are in the basement”, says Thomas Schaufler, head of Erste Asset Management. In the past five years (2010-2014), Austrians have “lost” around 24 billion euro in interest on their savings deposits, compared to the five years (2005-2009) preceding the financial crisis. Erste Bank's research department expects that interest rates will rise from 2017 at the earliest. “Irrespective of the level of interest rates, one simply has to consider one's saving goals and investment horizon”, says Thomas Schaufler. With a diversified portfolio one is in the best position to weather turmoil and crises financially.

Active wealth management increases in importance

YOU INVEST – an actively managed umbrella fund of Erste Sparinvest, offers a method to invest one's money in the long term, diversified in line with one's goals and risk tolerance. The strategy for three risk categories aims for achieving stable returns with as little volatility as possible. YOU INVEST is actively managed; the most attractive investment assets respectively, such as government bonds, corporate bonds, stocks but also alternative investment strategies, are continually and flexibly adjusted. “Our success demonstrates that we are on the right track with this approach: the fund is growing by approx. 1 - 2 m. euro every day”, Schaufler notes. The volume of the fund in Austria and at Erste Bank's CEE banking subsidiaries stands at around 1.3 bn. euro already. The entry level is low: With a one-off deposit of 5.000 euro and a monthly deposit of 50 euro one can already invest in YOU INVEST. According to the study, overall, the attitude toward investment has improved: while only 21% had a positive view of securities in 2010, this share already amounts to 27% today.

| PDF (392 KB) |