12.10.2016

Austrians are saving more, but are foregoing returns

- Average monthly savings amount at EUR 216

- 40% would buy securities if they knew more about them

- YouInvest grows to EUR 1.3 billion in assets under management

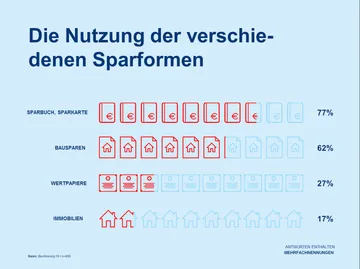

Saving chart infographic, © Erste Bank

Persistently low interest rates have been unable to diminish Austrians' passion for putting aside money in savings. With 7 out of 10 saying that saving continues to be important for them, the topic holds a slightly less important place than 10 years ago. Over the same time span, the nominal monthly savings amount has increased from EUR 132 in 2006 to EUR 216 in 2016. According to the Austrian National Bank (OeNB), private households held savings deposits totaling approx. EUR 230 billion as of July of this year, an increase of 3.2% over July 2015.

With respect to the forms of investment preferred by Austrians, almost nothing has changed compared to the previous year. However, in a comparison to the situation a decade earlier, one sees that the savings book has actually become even more popular as the top-ranked form of saving, with an increase to 77% (+6 percentage points versus 2006). 62% of respondents have entered into building savings contracts (+8 pp), investment in securities exhibits the largest increase with 27% (+13 pp), while 17% of respondents are currently investing in real estate

Low interest rates versus safety

77% of Austrians regard themselves as rather safety-conscious investors. They tolerate low interest rates, even if these cause them to lose money. “I believe many people have never bothered to calculate how much they are losing every day by keeping all their money in savings accounts,” says Thomas Schaufler, chief retail officer of Erste Bank. “Saving must no longer be equated exclusively with savings books in people's minds.” Only an investment mix of savings book, securities and insurance policies promises the best chances to generate long-term returns. “Keeping everything in a savings account is just as misguided as investing everything in the stock market,”, Schaufler comments.

Only 14% of Austrians see themselves as investors with a balanced approach – this is to say, investors who are partly focused on safety, and partly prepared to take risks. 5% of Austrians regard themselves as risk-tolerant investors.

What do Austrians think about stocks, investment funds, etc.? 6 out of 10 see them as an opportunity to make profits. Around 40% state that the importance of securities is rising and also consider them suitable vehicles for retirement provision. 80% are also aware of the risk that losses can be incurred through such investment approaches, while every second respondent thinks securities are difficult to understand.

More knowledge, more investment in securities?

More than 40% of Austrians would consider investing in securities if they had appropriate knowledge. When it comes to explaining financial terms, Austrians are often out of their depth. This is confirmed by the study’s results: 80% of the respondents are unable to define terms like “volatility”, 58% are unfamiliar with the term “issue price” and every second respondent has never heard about “face value.” 4 out of 10 are also unable to explain what “ATX” (the leading stock index of the Vienna Stock Exchange) stands for, and just as many don't even know what an “investment fund” is. “As advisors, one of our tasks is to explain such things in a comprehensible manner and to meet customers at their level of knowledge. This is the only way in which a sensible investment strategy can be worked out jointly with the client,” says Schaufler.

While the public’s knowledge about the subject of investments is not exactly well developed, it is worth noting that almost 8 out of 10 Austrians regard the advisor in their bank branch office as the preferred contact person regarding finance-related topics such as investment. Austrians are far less likely to rely on gaining such advice from friends and acquaintances, who range far behind with 28%, as does the internet with 18%. Schaufler: “We want to live up to the confidence placed in us by providing our clients with the best investment advisors in the marketplace.”

Three-quarters of Austrians have already had a consultation with an advisor from their house bank, with 59% of these also addressing the subject of investing.

Investment diversification as the solution

When considering the long term, one thing quickly becomes clear in the context of investment: there is no one-size-fits-all recipe that works equally well for everybody, and every asset class has its ups and downs. “This is why diversification across different asset classes is so important,” Schaufler emphasizes. The investment concept You Invest, which Erste Bank and Sparkassen launched three years ago, reflects precisely this approach. The managed umbrella fund with four risk categories has in the meantime garnered EUR 1.3 billion in assets under management. You Invest “Balanced”, with a current allocation of 70% bonds and 15% stocks, has attracted the largest share of investment interest. Its performance since inception amounts to approx. 3% p.a. This fund also reflects the safety-consciousness of Austrians quite well, due to its relatively conservative strategy. A new feature of You Invest is that investors can now join already with a lump sum deposit of EUR 3,000 (previously, the minimum had been EUR 10,000). It is now also possible to take advantage of You Invest without depositing a lump sum, namely by investing in instalments of EUR 50 per month through an s investment fund plan. www.youinvest.at