10.02.2016

Erste Bank Savings and Credit Forecast Q4

2017 Survey: Austrians want to save and spend in a balanced manner

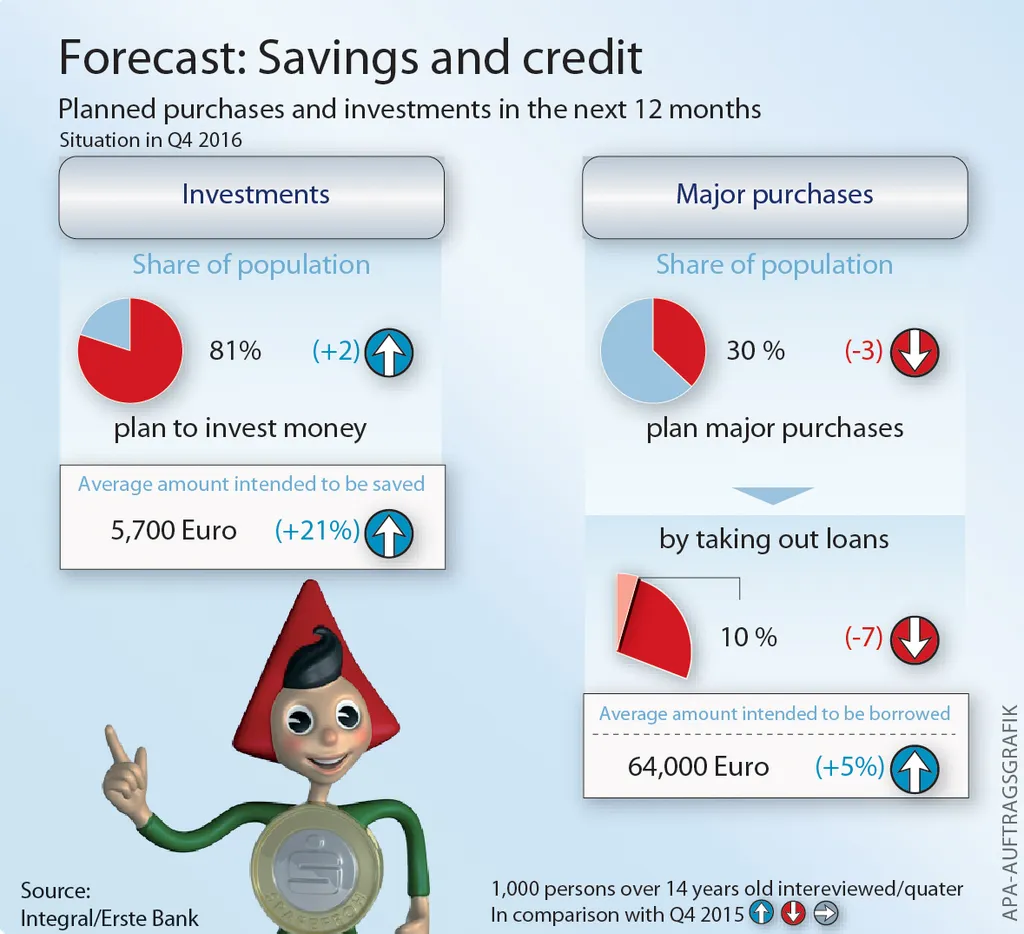

- 81% of Austrians plan to invest in 2017

- Life insurance policies and pension plans are gaining ground

- Average amount intended to be saved over 12 months: EUR 5,700

Investment in 2017: Pension Plans and Life Insurance Policies Are Gaining Ground

According to a study conducted by INTEGRAL on behalf of Erste Bank, 81% of Austrians (+2) plan to save or invest money in 2017. The topic of saving is of particular interest to people in the 30-49 year age group: altogether 90% want to either reinvest or newly invest money in the coming 12 months. Traditional forms of investment continue to be the most popular: 60% (+2) will put their money into a savings account again in the coming year, building savings contracts by and large remain stable with 50% (-3), the same applies to securities, which around one quarter of Austrians are interested in (±0). No fewer than 40% want to take out a life insurance policy (+5) and 35% (+7) are considering pension plans. Real estate is a topic of interest for 14% (+1) and gold gets a boost, as 13% plan to invest in it (+3).

Larger Amounts to be Saved and Borrowed

And how much money do Austrians want to put aside? Despite low interest rates, people envisage to set aside savings in the amount of EUR 5,700 over the coming months. Thus the average amount people want to invest has increased by EUR 1,000 compared to the previous year (+21%). Only every third respondent plans a major purchase, that is a decline of three percentage points compared to a year ago. 9 out of 10 Austrians use their own savings to finance such purchases (+6), only 10% are currently pondering whether to take out a loan (-7). The average amount they want to borrow has increased by 5% compared to the previous year though, and stands at EUR 64,000 at present. “At Erste Bank, the residential real estate business has grown sharply in recent months though”, notes Thomas Schaufler, chief retail officer of Erste Bank. “More than 80% of the loans we granted were fixed rate loans. In view of the current interest rate environment, this is in the interest of borrowers and definitely a very positive development.”

Spending and Saving

Even though interest rates on savings accounts and current accounts will stay at very low levels, the desire to save or spend is roughly in balance. 40% of Austrians intend to rather spend their money, but nearly as many (39%) prefer to set their money aside. Every fifth respondent hasn't given the subject any thought yet (21%). Particularly young people (14-29 years of age) are more inclined to spend their money, only 21% in this age group want to save. “Especially young people often don't think about setting money aside for their old age. But one can benefit a great deal in one's later years, even if one only invests 50 euro per month”, Schaufler remarks.

It is exactly the other way around among older persons (50+): 49% of them prefer to save, and only 26% would rather spend; the rest have no preference either way.

About the study: Integral has interviewed 1,000 Austrians (representative for Austria's population from the age of 14) via telephone about their plans regarding their preferred forms of saving and investment, as well as their financing needs. The survey was conducted in the 4th r quarter in the time period 18. November to 17. December 2016. Comparative figures refer to the same quarter of the previous year, unless indicated otherwise.