16.05.2016

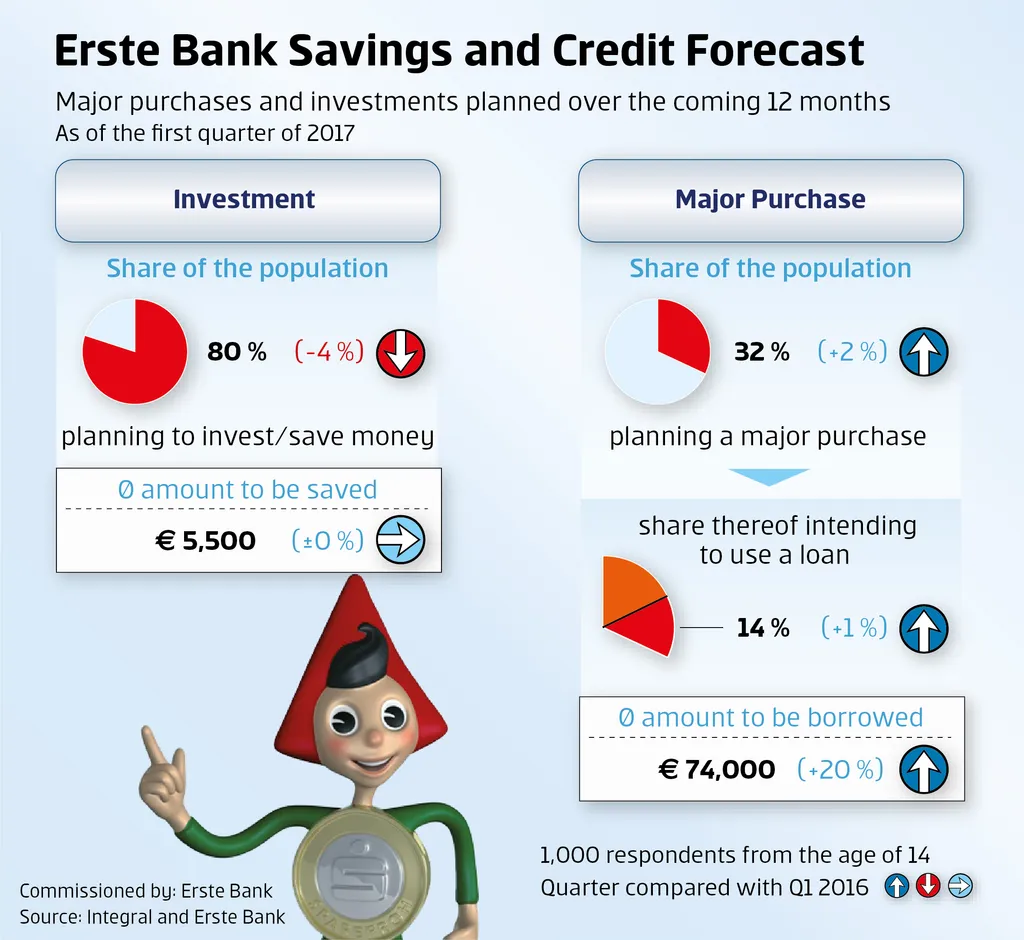

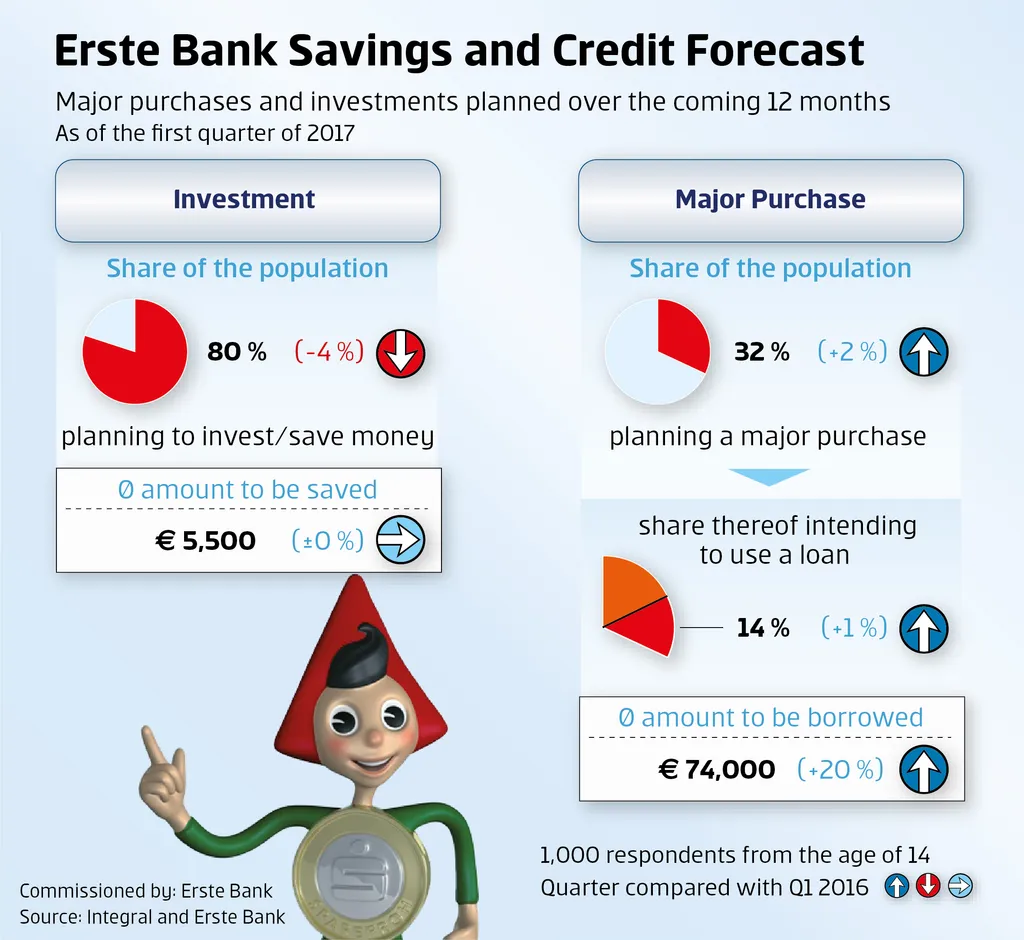

Erste Bank Savings and Credit Forecast Q1 2017

Survey: Average Loan Amount Increases by 20%

- Current average loan amount: EUR 74,700

- Upswing in investments in securities, real estate, and gold

- Austrians are pro euro

Austrians are eager to take up loans – that emerges from a recent INTEGRAL survey conducted on behalf of Erste Bank. Compared to the previous year, the average loan amount has increased by 20 percent to more than EUR 74,000 per person. By contrast, the average amount people intend to invest or save remains steady and stays at EUR 5,500. Savings books and building savings contracts are still the top-ranked investment choices, but gold becomes increasingly popular as well.

Austrians are safety-conscious investors

How much money do Austrians plan to put aside in coming months and what are their preferred investment choices? A recent INTEGRAL survey shows that 8 out of 10 Austrians want to save money in the coming months. Particularly households with a net income in excess of EUR 2,000 want to add something to their nest egg (88%). The average amount under consideration is EUR 5,500 (+/- 0% in Q1 2017 compared to Q1 2016). Although the popularity of traditional forms of saving has declined compared to the previous year, they remain the top-ranked choices: in coming months every 2nd Austrian (55%, -2%*) wants to put money into a savings account, 48% (-3%*) invest in a building savings contract, investing in a life insurance policy is of interest to 40% (+3%*) of the respondents. Austrians continue to be cautious about securities: investment funds, stocks and bonds are considered by every 4th Austrian (24%,-1%*). What stands out is that gold is increasingly gaining ground: 17% (+4%*) want to invest in it. “It’s important to make sure you diversify your investments. It absolutely can make sense to invest a small percentage in gold, namely as a complement to money placed in savings and securities. However, investors should always be aware that the value of gold sometimes fluctuates more sharply than investments in a globally diversified portfolio of securities. In addition, you don’t earn either interest or dividends when investing in gold,” notes Thomas Schaufler, the retail banking board member at Erste Bank Oesterreich. Interest in real estate remains steady as well: 22% plan to invest in a home in the coming year (+1%*).

How much money do Austrians plan to put aside in coming months and what are their preferred investment choices? A recent INTEGRAL survey shows that 8 out of 10 Austrians want to save money in the coming months. Particularly households with a net income in excess of EUR 2,000 want to add something to their nest egg (88%). The average amount under consideration is EUR 5,500 (+/- 0% in Q1 2017 compared to Q1 2016). Although the popularity of traditional forms of saving has declined compared to the previous year, they remain the top-ranked choices: in coming months every 2nd Austrian (55%, -2%*) wants to put money into a savings account, 48% (-3%*) invest in a building savings contract, investing in a life insurance policy is of interest to 40% (+3%*) of the respondents. Austrians continue to be cautious about securities: investment funds, stocks and bonds are considered by every 4th Austrian (24%,-1%*). What stands out is that gold is increasingly gaining ground: 17% (+4%*) want to invest in it. “It’s important to make sure you diversify your investments. It absolutely can make sense to invest a small percentage in gold, namely as a complement to money placed in savings and securities. However, investors should always be aware that the value of gold sometimes fluctuates more sharply than investments in a globally diversified portfolio of securities. In addition, you don’t earn either interest or dividends when investing in gold,” notes Thomas Schaufler, the retail banking board member at Erste Bank Oesterreich. Interest in real estate remains steady as well: 22% plan to invest in a home in the coming year (+1%*).

More credit financing

Nearly one third of Austrians intend to make a major purchase in the coming year. 91% want to finance it with their own savings (+4%*), 5% want to borrow from friends (+/- 0%*). 14% (+1%) ponder taking out a bank loan or a mortgage. The average amount people intend to borrow stands at EUR 74,700, which is far higher than in the previous year, when it amounted to just EUR 62,400. “That corresponds to a growth of 20 percent on the previous year and is a clear expression of confidence. People have regained their trust in the future and want to fulfil their ambitions,” Schaufler comments.

Euro seen as advantageous

There was already a lot of debate about the European currency union in the course of the BREXIT. What do Austrians think about the euro though? More than half of them (56%) consider the common European currency to be an advantage, 29% have a rather critical attitude toward it and 13% consider it neither an advantage nor a disadvantage. Particularly people with higher education levels, who have either a high school diploma (equivalent to A-levels or matriculation in some countries) and/or a university degree have a more positive view of the euro.

*Comparison between Q1 2016 and Q1 2017

About the study: Integral has interviewed 1,000 Austrians (representative of Austria's population from the age of 14) via telephone about their plans regarding forms of saving and investment, as well as their financing needs. The survey was conducted in the 2nd quarter in the time period 03. March to 04. April 2017. Unless indicated otherwise, comparative figures refer to the same quarter of the previous year.