09.08.2018

Erste Bank savings and credit forecast for Q2 2018

Survey: 26% of Austrians don’t care about low interest

Securities growing in popularity

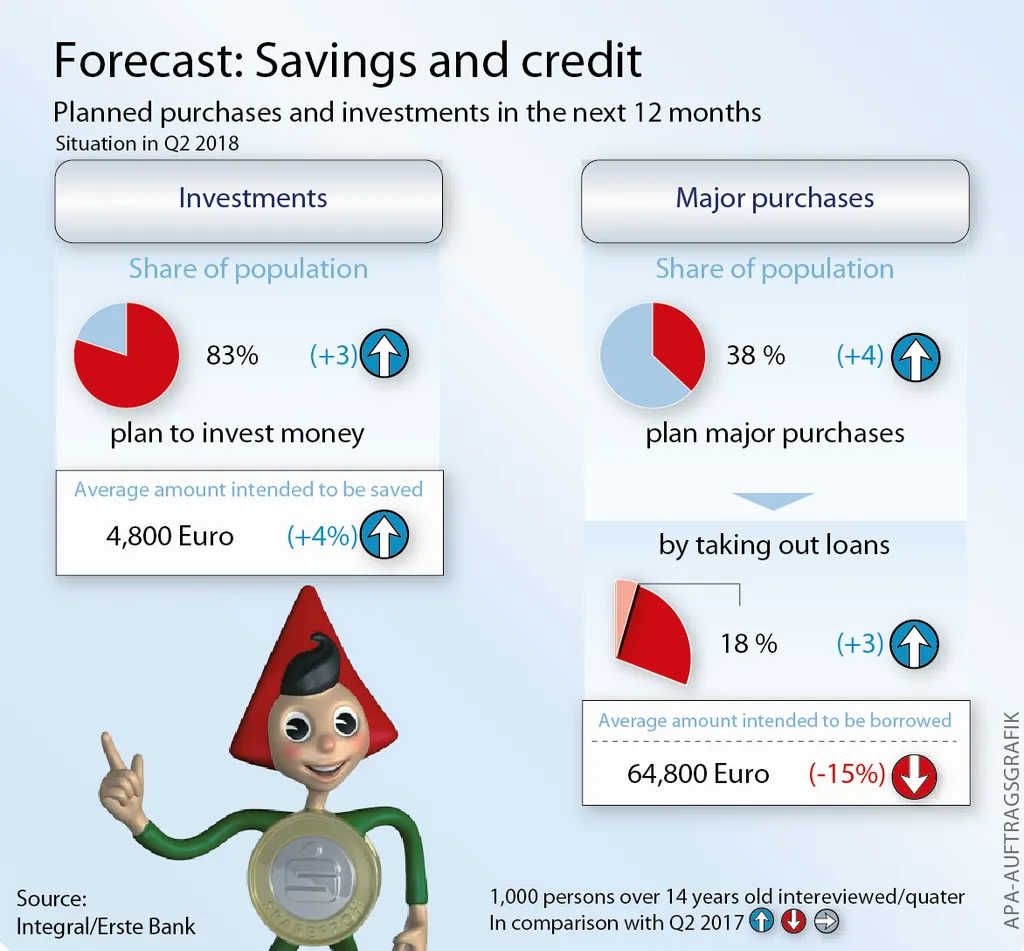

According to the latest INTEGRAL survey conducted on behalf of Erste Bank und Sparkassen, 8 in 10 Austrians want to save or invest money in the next 12 months. Investments of around 4,800 Euros on average are planned. This figure was 200 Euros lower during the same period in 2017. The most popular forms of investment continue to be savings books at 59% (+2), building-society contracts at 49% (+2), and life insurance at 34% (+2). Securities come in at 29%, which is 5 percent higher than in the 2nd quarter of last year. “That’s a good development given the ongoing zero interest. These days, it’s impossible to achieve any return on your capital without having securities in your portfolio”, says Thomas Schaufler, Director of Private Customer Business at Erste Bank Austria. At 34% (+3), pension schemes are also enjoying growing popularity, while property purchases are a focus for 18% (-1). Around 17% of Austrians do not plan to invest any money over the next 12 months.

Loan amounts dropping

38% of Austrians are planning to make a larger purchase over the next year (e.g. a new car or a renovation) – that’s 4% more than in Q2 2017. The vast majority (82%) of these purchases are financed through own savings, while 18% (+3) of people want to finance larger expenses using a bank loan or building-society loan. For those financing via a bank loan, the average loan amount is lower than last year, currently totalling 64,800 Euros (-15%). Fixed-interest loans continue to be all the rage, as they enable borrowers to know their exact repayment amounts for most of the loan term. At the Erste Bank, around 8 in 10 home loans are taken out with fixed interest.

Low-interest policy viewed negatively

Interest has been low for many years. The European Central Bank’s low-interest policy has meant virtually no interest earned in savings books. And at least one in two Austrians view this negatively. 19% find the situation good, because they think it stimulates the economy. More than a quarter even said they don’t care about the interest issue. Only 16% are worried about the ECB’s interest policy. The ECB has announced its intention to normalise its money policy and terminate the net purchase of loans at the end of 2018. Only sometime thereafter will it then be able to increase the interest rate. “Everything points to the fact that interest rates will thus remain at their current low level at least over the summer of 2019”, says Schaufler.

About the study: Integral interviewed 1,000 Austrians (representative for the Austrian population over 14) by telephone and online asking how they were planning to save and invest their money, and also about their finance needs. The survey was conducted in Q1 from the 8th to 19th of June 2018. Unless otherwise indicated, the figures of comparison are from the same quarter of the previous year.