18.09.2019

53 percent of Austrians perceive living as no longer affordable

53 percent of Austrians perceive living as no longer affordable

- Rental and property prices have risen faster than incomes

- Fixed rate loans for condos cheaper than ever

- Rental and property prices have risen faster than incomes

- Fixed rate loans for condos cheaper than ever

A rapidly growing population and a shortfall in affordable housing space are leading to rapidly rising real estate prices in Austria. This is also felt by the people. According to a recent survey by INTEGRAL on behalf of Erste Bank und Sparkassen, living is leading to an ever greater financial burden on the household budget. Almost half of Austrians consider housing no longer affordable. The prognosis for the future is bleak, as three quarters of Austrians assume that living in 2030 will hardly be affordable.

Rents and property prices are rising faster than income

A rapidly growing population and a shortfall in affordable housing space are leading to rapidly rising real estate prices in Austria. This is also felt by the people. According to a recent survey by INTEGRAL on behalf of Erste Bank und Sparkassen, living is leading to an ever greater financial burden on the household budget. Almost half of Austrians consider housing no longer affordable. The prognosis for the future is bleak, as three quarters of Austrians assume that living in 2030 will hardly be affordable.

Rents and property prices are rising faster than income

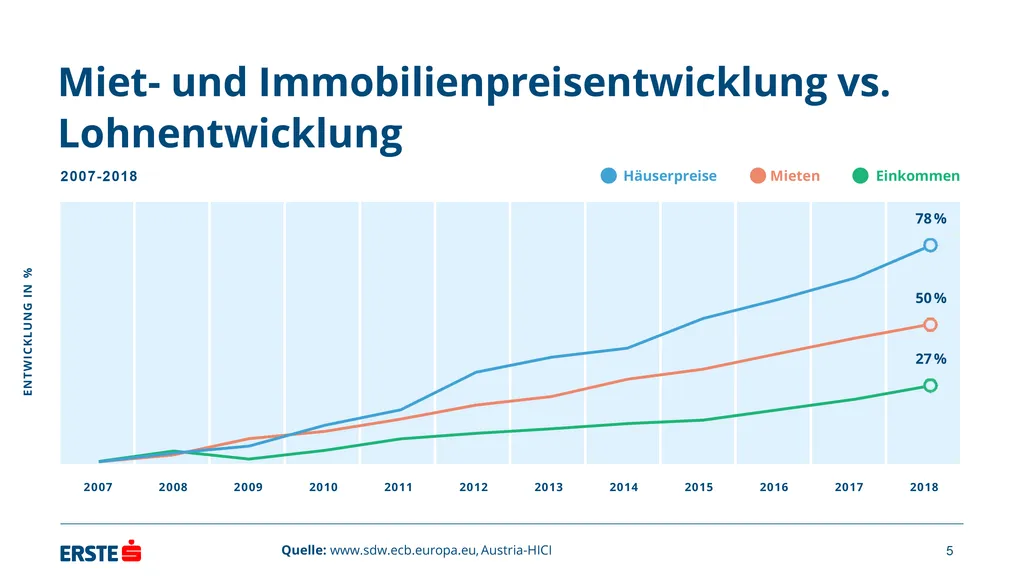

Nine out of ten Austrians say, according to the Integral survey, that rental and housing prices have risen faster than incomes. Statistics show that this is not only a feeling. According to official sources, since 2008, house prices have risen almost three times and rental rates on new leases have risen almost twice as fast as Austrian household income. “These developments are problematic. Housing costs should amount to a maximum of 30 percent of income, but today the factor of living already devours much more for many Austrians,” says Peter Bosek, CEO of Erste Bank.

An additional problem is that there is an increasing number of fixed-term leases on the market. Between 2008 and 2018, the share of fixed-term leases in the private sector increased from 30.2 percent to 45.8 percent.

The reason: landlords do not want to be tied up long-term to be able to make even better use of future price increases.

Non-profit residential building projects important for 9 out of 10 Austrians

Nine out of ten Austrians say, according to the Integral survey, that rental and housing prices have risen faster than incomes. Statistics show that this is not only a feeling. According to official sources, since 2008, house prices have risen almost three times and rental rates on new leases have risen almost twice as fast as Austrian household income. “These developments are problematic. Housing costs should amount to a maximum of 30 percent of income, but today the factor of living already devours much more for many Austrians,” says Peter Bosek, CEO of Erste Bank.

An additional problem is that there is an increasing number of fixed-term leases on the market. Between 2008 and 2018, the share of fixed-term leases in the private sector increased from 30.2 percent to 45.8 percent.

The reason: landlords do not want to be tied up long-term to be able to make even better use of future price increases.

Non-profit residential building projects important for 9 out of 10 Austrians

87 percent of the surveyed Austrians consider non-profit residential building projects important. According to Statistics Austria, six out of ten tenants live in a cooperative or municipal flat.

Bosek: “On average, around 15,000 subsidized apartments per year are completed in Austria, but the demand for subsidized flats is 22,000 units per year. So there is the striking lack of 7,000 low-cost apartments per year, and thus real estate prices go through the roof, especially in what was up to now the low-priced and medium-priced segment. “

Low interest rates provide opportunity for ownership

One way to avoid the ever-increasing rents is to buy a property. Again, of course, prices here have risen too and it is not easy to find still affordable condominiums. With a little perseverance, however, subsidized property or co-operative housing is still available. The zero interest rate of the European Central Bank makes lending rates as low as never before and thus also equity loans for, for example, co-operative housing can be financed at favourable conditions. Thomas Schaufler, CEO of Erste Bank: “The low-interest phase will continue for a longer time. You can’t emphasize it often enough: people really ought to secure themselves these low interest rates.” Even today, one can take out a housing loan over 100,000 Euros with a term of 25 years and a variable interest rate of 1.2 percent (381.06 Euros per month) or with a term of 15 years and a fixed interest rate of 1.3 percent (393.68 Euros per month). Schaufler: “Anyone who is willing to pay 12.62 Euros more per month for a loan can sleep easy for the next 15 years because the loan rate will remain the same.”

2.6 billion for subsidized housing

Erste Bank CEO Bosek: “Living has become a central issue in Austria and we see it as a social mission to make living affordable again.” Erste Bank has been very active in the field of housing in recent years. Financing of 2.6 billion Euros went into subsidized housing. With this money, 20,000 apartments, student and senior citizen homes were built in Austria. Bosek: “We will continue on this path in the coming years and even intensify our commitment due to the high demand.”

About the survey: On behalf of Erste Bank und Sparkassen, the market research institute INTEGRAL carried out an online survey with 1,800 participants (16-69 years) on the topic of "Affordable Housing" in June 2019. This survey is representative of the Austrian population.

| PDF (622 KB) | |

| JPG (919 KB) | |

| JPG (1 MB) |